12:45 PM | 0

comments

Monthly Wallpaper - May 2011: Twisted Pictures

Written By bross on Friday, April 29, 2011 | 11:00 PM

This month's Movie Dearest Calendar Wallpaper comes with a SPOILER WARNING! For the month of May, we are taking a look at the most celebrated cinematic plot twists, surprise twists and twist endings of all time... that's right: Twisted Pictures!

So beware if you never got around to finding out what Rosebud meant or who Keyser Söze is... and stay away from the Soylent Green.

Just click on the picture above to enlarge it to its 1024 x 768 size, then right click your mouse and select "Set as Background", and you're all set. If you want, you can also save it to your computer and set it up from there, or modify the size in your own photo-editing program if needed.

So beware if you never got around to finding out what Rosebud meant or who Keyser Söze is... and stay away from the Soylent Green.

Just click on the picture above to enlarge it to its 1024 x 768 size, then right click your mouse and select "Set as Background", and you're all set. If you want, you can also save it to your computer and set it up from there, or modify the size in your own photo-editing program if needed.

11:00 PM | 0

comments

Labels:

entertainment

Reverend's Reviews: Hop to That's What I Am

Written By bross on Thursday, April 28, 2011 | 11:00 PM

I seldom use adjectives like cute, adorable and charming to refer to movies; leading men, yes, but not movies. Well, that all changed on Easter Sunday when I finally treated myself to the bunny-blessed blockbuster Hop; not only does it feature adorable leading human James Marsden, but the film is as cute and cuddly as a plush, floppy-eared rabbit despite a character some may find offensive: a Spanish-accented chick named Carlos (voiced by Hank Azaria), who is secretly plotting to dethrone the reigning Easter Bunny (Hugh Laurie of TV's House).

Carlos sees an opportunity when the Easter Bunny's son and overwhelmed heir, E.B. (a great vocal turn by Russell Brand, who in general is better heard than seen), unexpectedly leaves the family headquarters beneath Easter Island — simultaneously obvious and clever — for Hollywood. E.B. wants to be a drummer in a rock & roll band, not travel the world once a year delivering eggs and candy.

Once in California, he is hit by a car driven by jobless slacker Fred (Marsden). Fred actually spied E.B.'s father one Easter morning when he was a kid, but he is initially reluctant to believe the talking, jelly bean-defecating rabbit who insists on rooming with him is the Easter Bunny, Jr. Meanwhile, dad's all-female, Ninja-trained royal guard — the Pink Berets — are closing in on E.B. with orders to take him home.

While the film's plot and screenplay are far from complex (and actually bear several similarities to the 1985 Christmas-themed epic Santa Claus: The Movie), Hop boasts dazzling visuals inside the Easter Bunny's lair, which includes a fantastic jellybean fountain. Having him make his holiday rounds in an egg-shaped "sleigh" pulled by hundreds of little yellow chicks is also an amusing touch. It also features a fine supporting cast that includes Kaley Cuoco (so great on The Big Bang Theory), Gary Cole and Elizabeth Perkins. Director Tim Hill (nephew of George Roy Hill, who helmed The Sting among other classics of the 1960's & 70's) progresses naturally from Alvin and the Chipmunks to rabbits.

Finally, I'm glad to see a movie that draws inspiration from secular images and traditions associated with Easter. Each year, we get multiple Yuletide offerings at the cineplex, so why not make more films about Santa's springtime counterpart? And while I like religious-themed movies as well this time of year, I'll take Hop (even with its racial-stereotype villain) over The Passion of the Christ any day.

Although in a more serious vein, the new release That's What I Am (opening this Friday in LA and NYC) is a charming, inspirational indie about the hot topic of bullying in schools. It is appropriate for older children and families. Produced somewhat improbably by World Wrestling Entertainment (WWE), the film's writer-director is Mike Pavone, the WWE's Executive Vice President.

That’s What I Am is essentially a coming-of-age story set in the mid-1960's that follows 12-year-old Andy Nichol (Chase Ellison of Tooth Fairy), a bright student who, like most kids his age, will do anything to avoid conflict for fear of suffering overwhelming ridicule and punishment from his junior high school peers.

Everyone’s favorite teacher, Mr. Simon (a terrific Ed Harris), decides to pair Andy with the school’s biggest outcast, Stanley a.k.a. “Big G†(impressive newcomer Alexander Walters), on a critical school project. Sporting thick orange hair (hence the "G" for "ginger"), a head too big for his body and ears too big for his head, Stanley has been an object of ridicule among the students since grade school. Embarrassed at first, Andy gradually takes a liking to Stanley and learns that there was truly a method behind Mr. Simon’s madness as to why he teamed the two up.

Whereas various students are bullied by others for an array of perceived deficits, Mr. Simon himself becomes the object of anti-gay bigotry. In this regard, That's What I Am couldn't be more timely despite its period trappings. Harris's real-life wife, Amy Madigan, beautifully plays the school's sympathetic principal, and WWE superstar Randy Orton makes an effective film debut as a homophobic father.

Pavone based the script on his own observations while he was in junior high, and it rings true. While the subject is deadly serious, Pavone works wry comic touches into the narration and dialogue that occasionally recalled for me Jean Shepherd's classic voiceover work in 1983's A Christmas Story.

Upholding as it does such time-honored principles as tolerance, human dignity and compassion, I recommend That's What I Am most highly.

Reverend's Ratings:

Hop: B

That's What I Am: B+

Review by Rev. Chris Carpenter, resident film critic of Movie Dearest and the Blade California.

Carlos sees an opportunity when the Easter Bunny's son and overwhelmed heir, E.B. (a great vocal turn by Russell Brand, who in general is better heard than seen), unexpectedly leaves the family headquarters beneath Easter Island — simultaneously obvious and clever — for Hollywood. E.B. wants to be a drummer in a rock & roll band, not travel the world once a year delivering eggs and candy.

Once in California, he is hit by a car driven by jobless slacker Fred (Marsden). Fred actually spied E.B.'s father one Easter morning when he was a kid, but he is initially reluctant to believe the talking, jelly bean-defecating rabbit who insists on rooming with him is the Easter Bunny, Jr. Meanwhile, dad's all-female, Ninja-trained royal guard — the Pink Berets — are closing in on E.B. with orders to take him home.

While the film's plot and screenplay are far from complex (and actually bear several similarities to the 1985 Christmas-themed epic Santa Claus: The Movie), Hop boasts dazzling visuals inside the Easter Bunny's lair, which includes a fantastic jellybean fountain. Having him make his holiday rounds in an egg-shaped "sleigh" pulled by hundreds of little yellow chicks is also an amusing touch. It also features a fine supporting cast that includes Kaley Cuoco (so great on The Big Bang Theory), Gary Cole and Elizabeth Perkins. Director Tim Hill (nephew of George Roy Hill, who helmed The Sting among other classics of the 1960's & 70's) progresses naturally from Alvin and the Chipmunks to rabbits.

Finally, I'm glad to see a movie that draws inspiration from secular images and traditions associated with Easter. Each year, we get multiple Yuletide offerings at the cineplex, so why not make more films about Santa's springtime counterpart? And while I like religious-themed movies as well this time of year, I'll take Hop (even with its racial-stereotype villain) over The Passion of the Christ any day.

Although in a more serious vein, the new release That's What I Am (opening this Friday in LA and NYC) is a charming, inspirational indie about the hot topic of bullying in schools. It is appropriate for older children and families. Produced somewhat improbably by World Wrestling Entertainment (WWE), the film's writer-director is Mike Pavone, the WWE's Executive Vice President.

That’s What I Am is essentially a coming-of-age story set in the mid-1960's that follows 12-year-old Andy Nichol (Chase Ellison of Tooth Fairy), a bright student who, like most kids his age, will do anything to avoid conflict for fear of suffering overwhelming ridicule and punishment from his junior high school peers.

Everyone’s favorite teacher, Mr. Simon (a terrific Ed Harris), decides to pair Andy with the school’s biggest outcast, Stanley a.k.a. “Big G†(impressive newcomer Alexander Walters), on a critical school project. Sporting thick orange hair (hence the "G" for "ginger"), a head too big for his body and ears too big for his head, Stanley has been an object of ridicule among the students since grade school. Embarrassed at first, Andy gradually takes a liking to Stanley and learns that there was truly a method behind Mr. Simon’s madness as to why he teamed the two up.

Whereas various students are bullied by others for an array of perceived deficits, Mr. Simon himself becomes the object of anti-gay bigotry. In this regard, That's What I Am couldn't be more timely despite its period trappings. Harris's real-life wife, Amy Madigan, beautifully plays the school's sympathetic principal, and WWE superstar Randy Orton makes an effective film debut as a homophobic father.

Pavone based the script on his own observations while he was in junior high, and it rings true. While the subject is deadly serious, Pavone works wry comic touches into the narration and dialogue that occasionally recalled for me Jean Shepherd's classic voiceover work in 1983's A Christmas Story.

Upholding as it does such time-honored principles as tolerance, human dignity and compassion, I recommend That's What I Am most highly.

Reverend's Ratings:

Hop: B

That's What I Am: B+

Review by Rev. Chris Carpenter, resident film critic of Movie Dearest and the Blade California.

11:00 PM | 0

comments

Labels:

entertainment

Reverend's Preview: Hero Worship

Written By bross on Wednesday, April 27, 2011 | 11:00 PM

Caped crusaders of various eras and genders will once again invade the Anaheim Convention Center, as the second Anaheim Comic Con runs there April 29-May 1. Presented by Wizard World, a multimedia company devoted to pop culture, the first Orange County event in 2010 drew a legion of fans, artists and collectors.

"Anaheim Comic Con was the most anticipated and attended new event of the Spring, and we are thrilled to come back to the Anaheim Convention Center with one of the hottest new shows going,†said Gareb Shamus, Wizard World CEO. “We will have an incredible array of celebrity guests, and many award-winning comic creators lined up.â€

Superheroes have hit an all time high in terms of popularity. Whether on the printed page via comic books or graphic novels, on television (a new Wonder Woman series, starring Friday Night Lights' Adrianne Palicki, is due next season) or on the silver screen (see a list of upcoming superhero movies below), there is currently no shortage of fictional crime fighters vying for our attention. Their increased visibility in recent years seems to be a response to very real cultural needs such as the pursuit of justice and a heightened desire for national security as well as world peace. This may hold especially true for GLBT citizens. When we still don't have full equality in terms of marriage and other social benefits, or when homosexuality remains a criminal offense in some countries, who among us doesn't long for a hard-bodied man or woman with super powers in a form-fitting outfit to save us?

While nowhere near as gargantuan as the annual San Diego Comic Con that takes place each July, Anaheim's Comic Con will nonetheless feature many of the same talents and vendors that populate it. There are also more than 400 celebrity guests scheduled to appear during the Anaheim con's three days. Among these are the original TV Batman and Robin, Adam West and Burt Ward; John Schneider of The Dukes of Hazzard, Desperate Housewives and Smallville fame; True Blood's Michael McMillian; Nicholas Brendon from Buffy the Vampire Slayer; and, for the ladies, the lovely Claudia Christian (Look) and Erika Eleniak (Baywatch).

One great benefit of the Anaheim Comic Con over San Diego's I discovered last year is that the celebrities are much more accessible for conversations and autographs. Whereas one can wait in line for hours in San Diego, I was able to walk right up to Star Trek's Nichelle Nichol and "Catwoman" Lee Meriwether last year and had very pleasant, unrushed chats with both. I also got to take pictures of a very sexy attendee wearing a Captain Marvel costume that left nothing to the imagination!

Fans can also meet their favorite comic creators and artists, including Judd Winick (Power Girl, Justice League), William Stout (The Dinosaurs), Mike Grell (Green Arrow, Green Lantern), Bill Sienkiewicz (Elektra: Assassin), Ethan Van Sciver (Green Lantern, Superman/Batman), Mark Texeira (Wolverine, Moon Night), Michael Golden (Batman, Hulk), Greg Horn (Spider-Man) and, last but by no means least, openly gay Phil Jimenez (Amazing Spider-Man, Astonishing X-Men).

Children and adult attendees are encouraged to come dressed as their favorite superhero, villain or pop culture personality for the chance to win special prizes in costume contests. Event-goers may also try their hand at interactive product exhibits and shop for collectible comics, movie and television memorabilia, toys and games at more than 100 dealer booths.

Anaheim Comic Con is the fourth stop on Wizard World's 2011 North American tour. Tickets are available in advance online at the con's official site at a savings over tickets purchased at the door.

SUPERHEROES EXPLODE ON THE BIG SCREEN

Over the next few months, the largest number of comics-based spectacles yet released in one movie season will arrive in theatres. Holding out for a hero? Prepare to be rescued!

Thor (opening May 6): The mythic Norse god makes his movie debut under the direction of Shakespearean pro Kenneth Branagh (Henry V, Much Ado About Nothing) and with a cast that boasts Oscar winners Natalie Portman and Anthony Hopkins. Hot newcomer Chris Hemsworth plays Thor.

Priest (opening May 13): Paul Bettany (Master and Commander: The Far Side of the World) stars as a vampire hunter in this horror flick based on a Korean comic. Star Trek's Karl Urban and Burlesque hottie Cam Gigandet co-star.

X-Men First Class (June 3): A reboot of the popular comics and movie series about warring mutants. Set in the early 1960's, the new film features younger versions of Professor X (James McAvoy of Wanted) and Magneto (Michael Fassbender from Inglorious Basterds) up against the Soviet Union and a villainous Kevin Bacon.

Green Lantern (June 17): Everyone's favorite hunky movie star, Ryan Reynolds, plays a military test pilot turned intergalactic policeman after a fateful encounter with a dying visitor from outer space. Peter Sarsgaard (Kinsey, An Education) co-stars as the new hero's alien-infected nemesis.

Captain America: The First Avenger (July 22): Chris Evans has already personified one classic hero, Johnny Storm, in the two Fantastic Four movies. Here, he faces his greatest challenge as a physically-enhanced soldier during World War II who must save America from an attack by Hitler's henchman, the Red Skull (Hugo Weaving of The Matrix).

Cowboys & Aliens (July 29): The title says it all in this big-screen adaptation of a graphic novel series. Harrison Ford and Daniel Craig don't play superheroes, but they are the best hope for a wild west town besieged by nasty space invaders.

Conan the Barbarian (August 19): Hunky Jason Momoa is tasked with filling Arnold Schwarzenegger's loincloth in this new version of the classic sword and sorcery character.

And just wait until 2012, when new Spider-Man, Batman, Wolverine and Superman movies are all scheduled to premiere!

Preview by Rev. Chris Carpenter, resident film critic of Movie Dearest and the Blade California.

"Anaheim Comic Con was the most anticipated and attended new event of the Spring, and we are thrilled to come back to the Anaheim Convention Center with one of the hottest new shows going,†said Gareb Shamus, Wizard World CEO. “We will have an incredible array of celebrity guests, and many award-winning comic creators lined up.â€

Superheroes have hit an all time high in terms of popularity. Whether on the printed page via comic books or graphic novels, on television (a new Wonder Woman series, starring Friday Night Lights' Adrianne Palicki, is due next season) or on the silver screen (see a list of upcoming superhero movies below), there is currently no shortage of fictional crime fighters vying for our attention. Their increased visibility in recent years seems to be a response to very real cultural needs such as the pursuit of justice and a heightened desire for national security as well as world peace. This may hold especially true for GLBT citizens. When we still don't have full equality in terms of marriage and other social benefits, or when homosexuality remains a criminal offense in some countries, who among us doesn't long for a hard-bodied man or woman with super powers in a form-fitting outfit to save us?

While nowhere near as gargantuan as the annual San Diego Comic Con that takes place each July, Anaheim's Comic Con will nonetheless feature many of the same talents and vendors that populate it. There are also more than 400 celebrity guests scheduled to appear during the Anaheim con's three days. Among these are the original TV Batman and Robin, Adam West and Burt Ward; John Schneider of The Dukes of Hazzard, Desperate Housewives and Smallville fame; True Blood's Michael McMillian; Nicholas Brendon from Buffy the Vampire Slayer; and, for the ladies, the lovely Claudia Christian (Look) and Erika Eleniak (Baywatch).

One great benefit of the Anaheim Comic Con over San Diego's I discovered last year is that the celebrities are much more accessible for conversations and autographs. Whereas one can wait in line for hours in San Diego, I was able to walk right up to Star Trek's Nichelle Nichol and "Catwoman" Lee Meriwether last year and had very pleasant, unrushed chats with both. I also got to take pictures of a very sexy attendee wearing a Captain Marvel costume that left nothing to the imagination!

Fans can also meet their favorite comic creators and artists, including Judd Winick (Power Girl, Justice League), William Stout (The Dinosaurs), Mike Grell (Green Arrow, Green Lantern), Bill Sienkiewicz (Elektra: Assassin), Ethan Van Sciver (Green Lantern, Superman/Batman), Mark Texeira (Wolverine, Moon Night), Michael Golden (Batman, Hulk), Greg Horn (Spider-Man) and, last but by no means least, openly gay Phil Jimenez (Amazing Spider-Man, Astonishing X-Men).

Children and adult attendees are encouraged to come dressed as their favorite superhero, villain or pop culture personality for the chance to win special prizes in costume contests. Event-goers may also try their hand at interactive product exhibits and shop for collectible comics, movie and television memorabilia, toys and games at more than 100 dealer booths.

Anaheim Comic Con is the fourth stop on Wizard World's 2011 North American tour. Tickets are available in advance online at the con's official site at a savings over tickets purchased at the door.

SUPERHEROES EXPLODE ON THE BIG SCREEN

Over the next few months, the largest number of comics-based spectacles yet released in one movie season will arrive in theatres. Holding out for a hero? Prepare to be rescued!

Thor (opening May 6): The mythic Norse god makes his movie debut under the direction of Shakespearean pro Kenneth Branagh (Henry V, Much Ado About Nothing) and with a cast that boasts Oscar winners Natalie Portman and Anthony Hopkins. Hot newcomer Chris Hemsworth plays Thor.

Priest (opening May 13): Paul Bettany (Master and Commander: The Far Side of the World) stars as a vampire hunter in this horror flick based on a Korean comic. Star Trek's Karl Urban and Burlesque hottie Cam Gigandet co-star.

X-Men First Class (June 3): A reboot of the popular comics and movie series about warring mutants. Set in the early 1960's, the new film features younger versions of Professor X (James McAvoy of Wanted) and Magneto (Michael Fassbender from Inglorious Basterds) up against the Soviet Union and a villainous Kevin Bacon.

Green Lantern (June 17): Everyone's favorite hunky movie star, Ryan Reynolds, plays a military test pilot turned intergalactic policeman after a fateful encounter with a dying visitor from outer space. Peter Sarsgaard (Kinsey, An Education) co-stars as the new hero's alien-infected nemesis.

Captain America: The First Avenger (July 22): Chris Evans has already personified one classic hero, Johnny Storm, in the two Fantastic Four movies. Here, he faces his greatest challenge as a physically-enhanced soldier during World War II who must save America from an attack by Hitler's henchman, the Red Skull (Hugo Weaving of The Matrix).

Cowboys & Aliens (July 29): The title says it all in this big-screen adaptation of a graphic novel series. Harrison Ford and Daniel Craig don't play superheroes, but they are the best hope for a wild west town besieged by nasty space invaders.

Conan the Barbarian (August 19): Hunky Jason Momoa is tasked with filling Arnold Schwarzenegger's loincloth in this new version of the classic sword and sorcery character.

And just wait until 2012, when new Spider-Man, Batman, Wolverine and Superman movies are all scheduled to premiere!

Preview by Rev. Chris Carpenter, resident film critic of Movie Dearest and the Blade California.

11:00 PM | 0

comments

Labels:

entertainment

Toon Talk: From HSM to NYC

Written By bross on Tuesday, April 26, 2011 | 11:00 PM

Spin-offs are tricky; for every Frasier, there’s a dozen Joeys. The key to a successful spin-off is a character that is interesting and compelling enough to break out of the supporting ranks to become a full-fledged leading player. So when it came time for Disney to try to milk their hit High School Musical franchise even further, it’s no surprise that they chose HSM’s resident diva, Sharpay Evans.

As played by blonde wannabe-dynamo Ashley Tisdale in two Disney Channel movies and one theatrical feature, Sharpay was a teenaged drama queen to be reckoned with, a rising star… at least in her own mind. And now she is the star, of her own direct-to-video movie, Sharpay’s Fabulous Adventure (now available on Disney DVD and Blu-ray Combo Pack).

and Blu-ray Combo Pack).

Alas, this Adventure is not that Fabulous. Borrowing heavily from such previous “girl power†chick flicks as Legally Blonde and The Devil Wears Prada, Sharpay’s first solo outing is as predictable, clichéd and preposterous as the all-pink wardrobe of its leading lady...

Click here to continue reading my Toon Talk review of Sharpay’s Fabulous Adventure at LaughingPlace.com.

As played by blonde wannabe-dynamo Ashley Tisdale in two Disney Channel movies and one theatrical feature, Sharpay was a teenaged drama queen to be reckoned with, a rising star… at least in her own mind. And now she is the star, of her own direct-to-video movie, Sharpay’s Fabulous Adventure (now available on Disney DVD

Alas, this Adventure is not that Fabulous. Borrowing heavily from such previous “girl power†chick flicks as Legally Blonde and The Devil Wears Prada, Sharpay’s first solo outing is as predictable, clichéd and preposterous as the all-pink wardrobe of its leading lady...

Click here to continue reading my Toon Talk review of Sharpay’s Fabulous Adventure at LaughingPlace.com.

11:00 PM | 0

comments

Labels:

entertainment

Reverend's Reviews: Straight & GLBT Collide in New DVDs

Written By bross on Monday, April 25, 2011 | 11:00 PM

It seems appropriate for three new DVDs exploring mash-ups of the hetero and homo/bi/trans worlds at the beginning of GLBT Pride season. First out of the gate is Breaking Glass Pictures' Straight & Butch , which was just released today. This intriguing documentary follows the multi-year odyssey undertaken by Butch Cordora, an openly gay Philadelphia TV host, to create a calendar in which he and an assortment of straight men would pose together nude. In re-creating iconic images including Janet Jackson's hands-on-breasts Rolling Stone cover, a nude John Lennon embracing Yoko Ono, and The Beatles' Abbey Road album cover sans clothing, Cordora hoped to find common ground between gay and straight men in the most intimate of photographic situations.

, which was just released today. This intriguing documentary follows the multi-year odyssey undertaken by Butch Cordora, an openly gay Philadelphia TV host, to create a calendar in which he and an assortment of straight men would pose together nude. In re-creating iconic images including Janet Jackson's hands-on-breasts Rolling Stone cover, a nude John Lennon embracing Yoko Ono, and The Beatles' Abbey Road album cover sans clothing, Cordora hoped to find common ground between gay and straight men in the most intimate of photographic situations.

While a few of the subjects were personal friends or co-workers of Cordora's before shooting and a couple are professional models, most are regular guys from the Philadelphia area. The film notes that 59 exclusively straight men in all were asked to participate, but 48 said "no" and refused to state their reasons for doing so on camera. A few wrote that their wife or girlfriend would be uncomfortable with them posing nude, at least with another man.

Those models who agreed include the husband of one of the photographers, a Whole Foods grocery store bag boy, a pizzeria owner, a professional wrestler, and a heavily-tattooed artist. There is also a nice ethnic mix among them, including two Black men, a Latino originally from Colombia, and an Asian. The men's initial comfort levels vary, as do their body types, but all save one come away from the experience of being photographed nude with Cordora feeling good about it. As one model remarks, "(The project) says something about our country or, more importantly, where our country could and should be" in terms of gay-straight relations. While Straight & Butch gets a little long and repetitive by the final shooting session, it is well worth watching.

Meanwhile, a lesbian-themed movie out May 3 on Wolfe Video, Bloomington , is generally worth avoiding. The plot initially focuses on the adjustment to college life in the titular Midwest city of a previously home-schooled young woman who also happens to be the former star of a cult science-fiction TV series à la Star Trek (to really drive the comparison home, the character's name is Jackie Kirk). Jackie, played by the Miley Cyrus-esque Sarah Stouffer, has good intentions of leaving showbiz behind and studying law. Things start to change, however, once she crosses paths with Abnormal Psychology professor Catherine Stark (the beautiful Allison McAtee).

, is generally worth avoiding. The plot initially focuses on the adjustment to college life in the titular Midwest city of a previously home-schooled young woman who also happens to be the former star of a cult science-fiction TV series à la Star Trek (to really drive the comparison home, the character's name is Jackie Kirk). Jackie, played by the Miley Cyrus-esque Sarah Stouffer, has good intentions of leaving showbiz behind and studying law. Things start to change, however, once she crosses paths with Abnormal Psychology professor Catherine Stark (the beautiful Allison McAtee).

Stark's reputation as a "vampire lesbo" (in the unflattering words of one student) who sleeps with her students precedes her. It isn't long before Stark confirms she is lesbian and begins an affair with Jackie. It also isn't long before Hollywood starts beckoning Jackie back for a movie version of her TV show. Fearful Catherine starts drinking and inexplicably sleeping with a man, while Jackie apparently realizes she needs to "straighten up" and have sex with a male fellow student if she is to have a chance at headlining a blockbuster movie.

Bloomington, written and directed by Fernanda Cardoso, starts promisingly but is ultimately compromised by its characters' shifting allegiances and alliances. Too much of the film is hard to swallow, from the casual way it treats an ethically-questionable sexual relationship between student and teacher to its perfunctory ending. Like Jackie, Cardoso may need to get back to basics academically.

The best by far of these new DVD releases is Casper Andreas' hilarious Violet Tendencies , out May 24 from Breaking Glass Pictures. Mindy Cohn, lovingly remembered by many of us as the irrepressible Natalie on the 1980's series The Facts of Life, stars as "the last fag hag" in Manhattan. Violet is adored by her large circle of gay friends and spends virtually all her free time with them. This makes it difficult for her to find romance with a "fag stag" or other straight man, for which she desperately longs, despite late nights on the "Frisky Friends" phone chat line and resultant, aborted dates.

, out May 24 from Breaking Glass Pictures. Mindy Cohn, lovingly remembered by many of us as the irrepressible Natalie on the 1980's series The Facts of Life, stars as "the last fag hag" in Manhattan. Violet is adored by her large circle of gay friends and spends virtually all her free time with them. This makes it difficult for her to find romance with a "fag stag" or other straight man, for which she desperately longs, despite late nights on the "Frisky Friends" phone chat line and resultant, aborted dates.

As much as she hates to do so, Violet cuts herself off from her boys once she meets Vern, an ex-Mormon architect from Idaho who reminded me a lot of Geoffrey Rush in Shine. But the boys will have none of it, devoted to Violet's happiness as they are, and begin to seek a more ideal partner for her... who may unknowingly be right in their midst.

Violet Tendencies kept getting away from me when it played last year's GLBT film festival circuit, and I'm so glad I finally saw it. The film is chock full of relatable, well-drawn characters, razor-sharp dialogue and witty observations (the screenplay was written by Jesse Archer, Andreas's frequent collaborator), and fabulous New York locations. Cohn's performance and those of the supporting cast are great, and there are cameos by such NYC gay icons as Hedda Lettuce, Michael Musto and Randy Jones, a.k.a. the Village People's Cowboy.

To quote Violet's dating advice-dispensing, food-deprived fashion model co-worker, Salome: "Get off your racket" and see Violet Tendencies ASAP!

Reverend's Ratings:

Straight & Butch: B

Bloomington: C-

Violet Tendencies: A-

Review by Rev. Chris Carpenter, resident film critic of Movie Dearest and the Blade California.

While a few of the subjects were personal friends or co-workers of Cordora's before shooting and a couple are professional models, most are regular guys from the Philadelphia area. The film notes that 59 exclusively straight men in all were asked to participate, but 48 said "no" and refused to state their reasons for doing so on camera. A few wrote that their wife or girlfriend would be uncomfortable with them posing nude, at least with another man.

Those models who agreed include the husband of one of the photographers, a Whole Foods grocery store bag boy, a pizzeria owner, a professional wrestler, and a heavily-tattooed artist. There is also a nice ethnic mix among them, including two Black men, a Latino originally from Colombia, and an Asian. The men's initial comfort levels vary, as do their body types, but all save one come away from the experience of being photographed nude with Cordora feeling good about it. As one model remarks, "(The project) says something about our country or, more importantly, where our country could and should be" in terms of gay-straight relations. While Straight & Butch gets a little long and repetitive by the final shooting session, it is well worth watching.

Meanwhile, a lesbian-themed movie out May 3 on Wolfe Video, Bloomington

Stark's reputation as a "vampire lesbo" (in the unflattering words of one student) who sleeps with her students precedes her. It isn't long before Stark confirms she is lesbian and begins an affair with Jackie. It also isn't long before Hollywood starts beckoning Jackie back for a movie version of her TV show. Fearful Catherine starts drinking and inexplicably sleeping with a man, while Jackie apparently realizes she needs to "straighten up" and have sex with a male fellow student if she is to have a chance at headlining a blockbuster movie.

Bloomington, written and directed by Fernanda Cardoso, starts promisingly but is ultimately compromised by its characters' shifting allegiances and alliances. Too much of the film is hard to swallow, from the casual way it treats an ethically-questionable sexual relationship between student and teacher to its perfunctory ending. Like Jackie, Cardoso may need to get back to basics academically.

The best by far of these new DVD releases is Casper Andreas' hilarious Violet Tendencies

As much as she hates to do so, Violet cuts herself off from her boys once she meets Vern, an ex-Mormon architect from Idaho who reminded me a lot of Geoffrey Rush in Shine. But the boys will have none of it, devoted to Violet's happiness as they are, and begin to seek a more ideal partner for her... who may unknowingly be right in their midst.

Violet Tendencies kept getting away from me when it played last year's GLBT film festival circuit, and I'm so glad I finally saw it. The film is chock full of relatable, well-drawn characters, razor-sharp dialogue and witty observations (the screenplay was written by Jesse Archer, Andreas's frequent collaborator), and fabulous New York locations. Cohn's performance and those of the supporting cast are great, and there are cameos by such NYC gay icons as Hedda Lettuce, Michael Musto and Randy Jones, a.k.a. the Village People's Cowboy.

To quote Violet's dating advice-dispensing, food-deprived fashion model co-worker, Salome: "Get off your racket" and see Violet Tendencies ASAP!

Reverend's Ratings:

Straight & Butch: B

Bloomington: C-

Violet Tendencies: A-

Review by Rev. Chris Carpenter, resident film critic of Movie Dearest and the Blade California.

11:00 PM | 0

comments

Labels:

entertainment

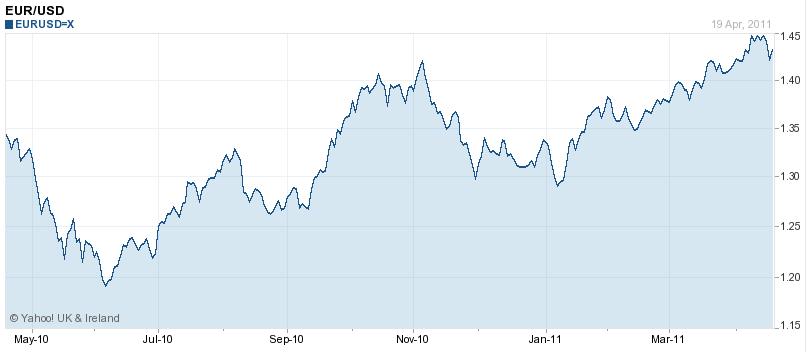

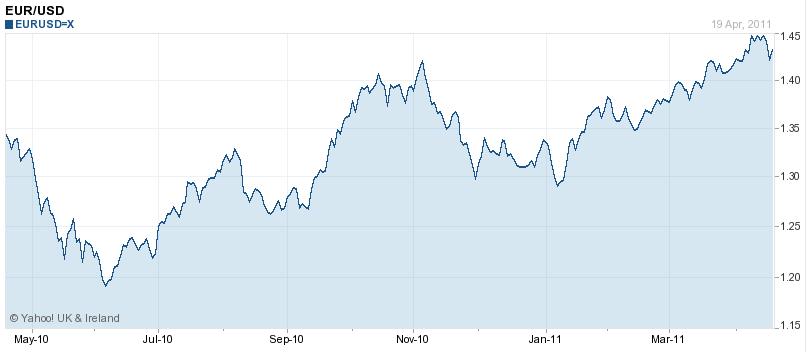

Interest Rates Outlook Causes Weekly Slump of Dollar, Forex

Written By bross on Sunday, April 24, 2011 | 2:02 PM

The US dollar was performing terribly this week against both commodity and safe currencies among signs of economic growth and on speculation that the Federal Reserve will lag with an increase of the interest rates.

The bad performance of the US currency against its safe-haven counterparts was expected, but the drop versus currencies linked to growth wasn’t anticipated. The persisting Europe’s problems with sovereign debt should’ve spurred the greenback against commodity currencies, but that hasn’t happened. It’s surprising to see how easily markets shook off fears of the European crisis and restored their risk appetite.

The strength of commodity currencies against the dollar has the same explanation as before: the global recovery. The US economy itself provided very the confusing signs: while its weak housing market turned out to be better than it was considered, the growth of manufacturing, the one of the strongest US sectors, slowed significantly and unexpectedly. As for performance versus other currencies, analysts remind us about the same old story: the quantitative easing. The US policy makers started talking about an end to the accommodative stance, but talks aren’t enough when other banks, most notably the European Central Bank and Sweden’s Riksbank, already began raising their borrowing costs.

EUR/USD has broken its resistance and jumped from 1.4411 to 1.4647, the highest level since December 2009, over the week, closing at 1.4559. USD/JPY fell from 83.21 to 81.85. USD/SEK closed at 6.1034 after opening at 6.1930 and reaching 6.0717, the lowest level since August 2008.

If you have any questions, comments or opinions regarding the US Dollar, feel free to post them using the commentary form below.

She is Thai sexy actress and popular model, Woranuch Wongsawan. Her nickname is Noon. Noon is one of the famous actress and model in Thailand. She was born in 1980 and studied at College of Nathasin.

She is Thai sexy actress and popular model, Woranuch Wongsawan. Her nickname is Noon. Noon is one of the famous actress and model in Thailand. She was born in 1980 and studied at College of Nathasin.

Thai sexy actress, Thai popular actress. Thai pretty girl, Asian pretty model, Asian sexy girl.

Thai sexy actress, Thai popular actress. Thai pretty girl, Asian pretty model, Asian sexy girl.

Pictures

The bad performance of the US currency against its safe-haven counterparts was expected, but the drop versus currencies linked to growth wasn’t anticipated. The persisting Europe’s problems with sovereign debt should’ve spurred the greenback against commodity currencies, but that hasn’t happened. It’s surprising to see how easily markets shook off fears of the European crisis and restored their risk appetite.

The strength of commodity currencies against the dollar has the same explanation as before: the global recovery. The US economy itself provided very the confusing signs: while its weak housing market turned out to be better than it was considered, the growth of manufacturing, the one of the strongest US sectors, slowed significantly and unexpectedly. As for performance versus other currencies, analysts remind us about the same old story: the quantitative easing. The US policy makers started talking about an end to the accommodative stance, but talks aren’t enough when other banks, most notably the European Central Bank and Sweden’s Riksbank, already began raising their borrowing costs.

EUR/USD has broken its resistance and jumped from 1.4411 to 1.4647, the highest level since December 2009, over the week, closing at 1.4559. USD/JPY fell from 83.21 to 81.85. USD/SEK closed at 6.1034 after opening at 6.1930 and reaching 6.0717, the lowest level since August 2008.

If you have any questions, comments or opinions regarding the US Dollar, feel free to post them using the commentary form below.

She is Thai sexy actress and popular model, Woranuch Wongsawan. Her nickname is Noon. Noon is one of the famous actress and model in Thailand. She was born in 1980 and studied at College of Nathasin.

She is Thai sexy actress and popular model, Woranuch Wongsawan. Her nickname is Noon. Noon is one of the famous actress and model in Thailand. She was born in 1980 and studied at College of Nathasin.

Thai sexy actress, Thai popular actress. Thai pretty girl, Asian pretty model, Asian sexy girl.

Thai sexy actress, Thai popular actress. Thai pretty girl, Asian pretty model, Asian sexy girl. Pictures

2:02 PM | 0

comments

Managed Account Forex Trading Software – Automated Forex Trading Software- Web-Based Forex Trading Software- Computer-Based Forex Trading Software

Managed Account Forex Trading Software – Automated Forex Trading Software- Web-Based Forex Trading Software- Computer-Based Forex Trading Software

Foreign exchange or forex is a booming market and most of us are tempted to try our hand in this money game. Day trading refers to buying and selling of stocks most commonly in the foreign exchange market. As it deals with funds, a trader is required to be well funded, and the success depends on several factors, like the choice of software, choice of forex trading systems, understanding of the market, stock brokers, etc. So what is a forex trading software?

Well, these are trading software that help the trader in analysis and trade execution. It is difficult to name the best forex trading software because each forex broker has software with different features. Selecting a software is always about personal preference and your technical skills and trading style.

The best part about currency trading is you opportunity to make money even if the stock market is low, as there is always a variance in different currency rate.

Types of Forex Trading Software

There are four types of forex trading software and selecting one depends on your need and suitability. Before you zero in on a name, it is first important to understand what type is the best forex trading software for you. Here are the four types of trading software with the names of best currency trading software for each types.

Web-Based Forex Trading Software

This type of currency trading is done using a computer with internet connection from any location. Here the trader needs to go online using a user name and password. The main advantage of this type of software is that the user can access it from anywhere in the world and there is no need to download a software. This is a secure trading software, as your information is in an encrypted form and the software provider always has a backup of your data, in case of data loss. Easy-forex and eToro are some of the best best forex trading software if you wish to carry out online trading.

Computer-Based Forex Trading Software

This type of currency trading can be done using your local desktop or laptop computer. Though this is convenient for most people, there are a number of risks attached to this type of currency trading, like data loss and computer virus. Make sure you have a good internet connection for fast transfer of data, else it might have a negative impact on your trading. So whenever you use this type of software, always create a backup file, keep the data password protected and make sure your computer has a strong and genuine antivirus software. MetaTrader and VT Trader are good stand-alone forex trading software.

Automated Forex Trading Software

The introduction of automated forex trading software has made trading easier, faster and less taxing. You do not waste your time understanding and is quite inexpensive compared to other types of software. The convenience of use and implementation, high accuracy, good return for investment and cost should be the important criteria to look for, while deciding which is the best forex trading software for you. These are also known as day trading robots as the trading is done by the software itself with minimum or no help from your end, so it is mostly used by beginners to learn the ropes of the trade. Forex Tracer, Forex Autopilot and Forex Raptor are some highly recommended and best automated forex trading software available in the market.

Managed Account Forex Trading Software

This is a software for those people who are interested in investing money in forex trading, but do not have the time or interest in trading themselves. Here a trading expert manages your account on your behalf with the help of this software. This is also for those who have tried their hand, but do not have the required knowledge and skills for trading. Some established names of this type of software are CTS Forex, ZuluTrade and dbFX.

Tips for Choosing a Forex Trading Software

Since you are dealing with money, and in a highly competitive market, there are very high chances of loss if you are not cautious enough. Trading means one man’s loss is another man’s gain. So you don’t want to be at the losing end, and want good returns for your investment. So, these are few tips to help you choose the best forex trading software available online:

Tip 1: Never buy a software before trying. Most stock brokers offer a trial version of their software, so try out a few software before you buy one.

Tip 2: Once you have tried a few software, select one that is fast and saves time.

Tip 3: Look for a user friendly software. You do not want to waste most of your time in understanding the features of the software.

Tip 4: Read best forex trading software reviews and comments online about the software of your interest.

Tip 5: Always check if the software is compatible with your computer system. Otherwise, see if you have the flexibility to upgrade the system.

Tip 6: Check for technical support of the trading software. A good software should also have a good technical support staff, in case of emergency or any glitches.

How often have you come across websites that vouch to make your 00 to 0000 in four hours? Well the numbers might differ, but the claims are still the same, to make you rich in just a few hours. Don’t get fooled by these claims. You are not the only trader in the market, there are thousands of people with the same goal and do not forget, there are Wall Street pros that you are competing against. Whatever you choose as the best forex trading software according to your requirements, the best lesson in currency trading is to keep realistic expectation. Don’t expect a miracle by giving in four hours of you time when there a people sitting there trading 24 hours a day. As trading software is an important part of the trading business, always read about the reputation of the software before you invest your money.

Foreign exchange or forex is a booming market and most of us are tempted to try our hand in this money game. Day trading refers to buying and selling of stocks most commonly in the foreign exchange market. As it deals with funds, a trader is required to be well funded, and the success depends on several factors, like the choice of software, choice of forex trading systems, understanding of the market, stock brokers, etc. So what is a forex trading software?

Well, these are trading software that help the trader in analysis and trade execution. It is difficult to name the best forex trading software because each forex broker has software with different features. Selecting a software is always about personal preference and your technical skills and trading style.

The best part about currency trading is you opportunity to make money even if the stock market is low, as there is always a variance in different currency rate.

Types of Forex Trading Software

There are four types of forex trading software and selecting one depends on your need and suitability. Before you zero in on a name, it is first important to understand what type is the best forex trading software for you. Here are the four types of trading software with the names of best currency trading software for each types.

Web-Based Forex Trading Software

This type of currency trading is done using a computer with internet connection from any location. Here the trader needs to go online using a user name and password. The main advantage of this type of software is that the user can access it from anywhere in the world and there is no need to download a software. This is a secure trading software, as your information is in an encrypted form and the software provider always has a backup of your data, in case of data loss. Easy-forex and eToro are some of the best best forex trading software if you wish to carry out online trading.

Computer-Based Forex Trading Software

This type of currency trading can be done using your local desktop or laptop computer. Though this is convenient for most people, there are a number of risks attached to this type of currency trading, like data loss and computer virus. Make sure you have a good internet connection for fast transfer of data, else it might have a negative impact on your trading. So whenever you use this type of software, always create a backup file, keep the data password protected and make sure your computer has a strong and genuine antivirus software. MetaTrader and VT Trader are good stand-alone forex trading software.

Automated Forex Trading Software

The introduction of automated forex trading software has made trading easier, faster and less taxing. You do not waste your time understanding and is quite inexpensive compared to other types of software. The convenience of use and implementation, high accuracy, good return for investment and cost should be the important criteria to look for, while deciding which is the best forex trading software for you. These are also known as day trading robots as the trading is done by the software itself with minimum or no help from your end, so it is mostly used by beginners to learn the ropes of the trade. Forex Tracer, Forex Autopilot and Forex Raptor are some highly recommended and best automated forex trading software available in the market.

Managed Account Forex Trading Software

This is a software for those people who are interested in investing money in forex trading, but do not have the time or interest in trading themselves. Here a trading expert manages your account on your behalf with the help of this software. This is also for those who have tried their hand, but do not have the required knowledge and skills for trading. Some established names of this type of software are CTS Forex, ZuluTrade and dbFX.

Tips for Choosing a Forex Trading Software

Since you are dealing with money, and in a highly competitive market, there are very high chances of loss if you are not cautious enough. Trading means one man’s loss is another man’s gain. So you don’t want to be at the losing end, and want good returns for your investment. So, these are few tips to help you choose the best forex trading software available online:

Tip 1: Never buy a software before trying. Most stock brokers offer a trial version of their software, so try out a few software before you buy one.

Tip 2: Once you have tried a few software, select one that is fast and saves time.

Tip 3: Look for a user friendly software. You do not want to waste most of your time in understanding the features of the software.

Tip 4: Read best forex trading software reviews and comments online about the software of your interest.

Tip 5: Always check if the software is compatible with your computer system. Otherwise, see if you have the flexibility to upgrade the system.

Tip 6: Check for technical support of the trading software. A good software should also have a good technical support staff, in case of emergency or any glitches.

How often have you come across websites that vouch to make your 00 to 0000 in four hours? Well the numbers might differ, but the claims are still the same, to make you rich in just a few hours. Don’t get fooled by these claims. You are not the only trader in the market, there are thousands of people with the same goal and do not forget, there are Wall Street pros that you are competing against. Whatever you choose as the best forex trading software according to your requirements, the best lesson in currency trading is to keep realistic expectation. Don’t expect a miracle by giving in four hours of you time when there a people sitting there trading 24 hours a day. As trading software is an important part of the trading business, always read about the reputation of the software before you invest your money.

For More Information About Automated Forex Trading Software Platform and a Forex Programs , Visit *** Forex AutoMoney***

Article from articlesbase.com

Article from articlesbase.com

1:54 PM | 0

comments

Icelandic Kronur: Lessons from a Failed Carry Trade

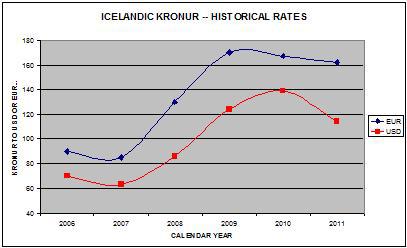

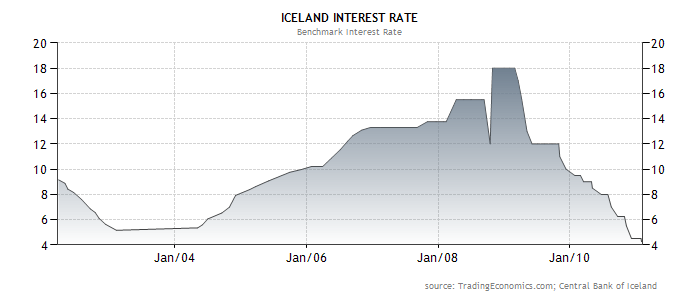

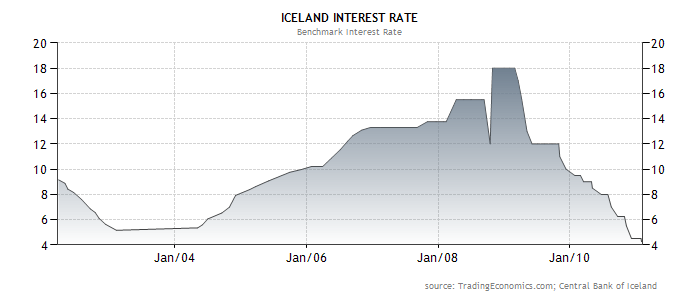

A little more than two years ago, the Icelandic Kronur was one of the hottest currencies in the world. Thanks to a benchmark interest rate of 18%, the Kronur had particular appeal for carry traders, who worried not about the inherent risks of such a strategy. Shortly thereafter, the Kronur (as well as Iceland’s economy and banking sector) came crashing down, and many traders were wiped out. Now that a couple of years have passed, it’s probably worth reflecting on this turn of events.

At its peak, nominal GDP was a relatively modest $20 Billion, sandwiched between Nepal and Turkmenistan in the global GDP rankings. Its population is only 300,000, its current account has been mired in persistent deficit, and its Central Bank boasts a mere $8 Billion in foreign exchange reserves. That being the case, why did investors flock to Iceland and not Turkmenistan?

The short answer to that question is interest rates. As I said, Iceland’s benchmark interest rate exceeded 18% at its peak. There are plenty of countries that offered similarly high interest rates, but Iceland was somehow perceived as being more stable. While it didn’t join the European Union until last year, Iceland has always benefited from its association with Europe in general, and Scandinavia in particular. Thanks to per capita GDP of $38,000 per person, its reputation as a stable, advanced economy was not unwarranted.

On the other hand, Iceland has always struggled with high inflation, which means its interest rates were never very high in real terms. In addition, the deregulation of its financial sector opened the door for its banks to take huge risks with deposits. Basically, depositors – many from outside the country – parked their savings in Icelandic banks, which turned around and invested the money in high-yield / high-risk ventures. When the credit crisis struck, its banks were quickly wiped out, and the government chose not to follow in the footsteps of other governments and bail them out.

Moreover, it doesn’t look like Iceland will regain its luster any time soon. Its economy has shrunk by 40% over the last two years, and one prominent economist has estimated that it will take 7-10 years for it to fully recover. Unemployment and inflation remain high even though interest rates have been cut to 4.25% – a record low. The Kronur has lost 50% of its value against the Dollar and the Euro, the stock market has been decimated, and the recent decision to not remunerate Dutch and British insurance companies that lost money in Iceland’s crash will only serve to further spook foreign investors. In short, while the Kronur will probably recover some of its value over the next few years (aided by the possibility of joining the Euro), it probably won’t find itself on the radar screens of carry traders anytime soon.In hindsight, Iceland’s economy was an accident waiting to happen, and the global financial crisis only magnified the problem. With Iceland – as well as a dozen other currencies and securities – investors believed they had found the proverbial free lunch. After all, where else could you earn an 18% by putting money in a savings account? Never mind that inflation was just as high; with the Kronur rising, carry traders felt assured that they would make a tidy profit on any funds deposited in Iceland.

At its peak, nominal GDP was a relatively modest $20 Billion, sandwiched between Nepal and Turkmenistan in the global GDP rankings. Its population is only 300,000, its current account has been mired in persistent deficit, and its Central Bank boasts a mere $8 Billion in foreign exchange reserves. That being the case, why did investors flock to Iceland and not Turkmenistan?

The short answer to that question is interest rates. As I said, Iceland’s benchmark interest rate exceeded 18% at its peak. There are plenty of countries that offered similarly high interest rates, but Iceland was somehow perceived as being more stable. While it didn’t join the European Union until last year, Iceland has always benefited from its association with Europe in general, and Scandinavia in particular. Thanks to per capita GDP of $38,000 per person, its reputation as a stable, advanced economy was not unwarranted.

On the other hand, Iceland has always struggled with high inflation, which means its interest rates were never very high in real terms. In addition, the deregulation of its financial sector opened the door for its banks to take huge risks with deposits. Basically, depositors – many from outside the country – parked their savings in Icelandic banks, which turned around and invested the money in high-yield / high-risk ventures. When the credit crisis struck, its banks were quickly wiped out, and the government chose not to follow in the footsteps of other governments and bail them out.

Moreover, it doesn’t look like Iceland will regain its luster any time soon. Its economy has shrunk by 40% over the last two years, and one prominent economist has estimated that it will take 7-10 years for it to fully recover. Unemployment and inflation remain high even though interest rates have been cut to 4.25% – a record low. The Kronur has lost 50% of its value against the Dollar and the Euro, the stock market has been decimated, and the recent decision to not remunerate Dutch and British insurance companies that lost money in Iceland’s crash will only serve to further spook foreign investors. In short, while the Kronur will probably recover some of its value over the next few years (aided by the possibility of joining the Euro), it probably won’t find itself on the radar screens of carry traders anytime soon.

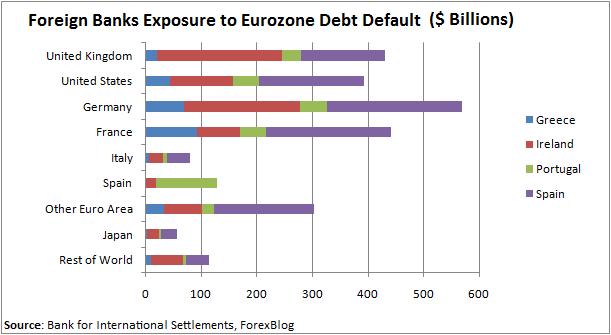

The collapse of the Kronur, however, has shown us that the carry trade is anything but risk-free. In fact, 18% is more than what lenders to Greece and Ireland can expect to earn, which means that it is ultimately a very risky investment. In this case, the 18% that was being paid to depositors were generated by making very risky investments. As the negotiations with the insurance companies have revealed, depositors had nothing protecting them from bank failure, which is ultimately what happened.

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case – since most countries won’t let their banks fail – traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case – since most countries won’t let their banks fail – traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.

When you enter into a carry trade, understand that a spike in volatility could wipe out all of your profits in one session. The only way to minimize your risk is to hedge your exposure. Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case – since most countries won’t let their banks fail – traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.

Now that the carry trade is making a comeback, it’s probably a good time to take a step back and re-assess the risks of such a strategy. Even if Iceland proves to be an extreme case – since most countries won’t let their banks fail – traders must still acknowledge the possibility of massive currency depreciation. In other words, even if the deposits themselves are guaranteed, there is an ever-present risk that converting that deposit back into one’s home currency will result in losses. That’s especially true for a currency that is as illiquid as the Kronur (so illiquid that it took me a while to even find a reliable quote!), and is susceptible to liquidity crunches and short squeezes.

1:34 PM | 0

comments

Labels:

Forex

Forex Win to Loss Ratios

It has been observed that majority of the individual traders in the Forex market function with no trading technique; hence over the longer period of time, they incur high losses. A Forex trading system or tactic is gear to present you an upper hand in the Forex market.

Better to Work with a Systematic Approach

A Forex trading system verifies whether you are earning profit or not in a Forex market. If you make your trading in a methodical manner then your win to loss ratios will be better than the other traders or investors.

Good Trading System

An excellent trading system is that which has already been evaluated by the investors; hence it has an upper hand in the market and also deliver reasonable amount of earning on continuous basis. A gainful and money making Forex system may have win to loss ratio (the percentage of trades with winning to the trades with losing) of 80 percent.

On the other hand the profit/loss ratio on the volume of the standard win to the volume of standard loss may be 2-3 to 1. You can promptly discover that the mishmash of win/loss and profit/loss proportions (renowned as profitability ratio) enlightens you that the system is money making or not.

How Profitability of System can be Determined?

If you proliferate, the sum of profitability ratio must be more than one. Till the time you get this figure more than one, the system is gainful. Preferably the bigger figure is better

Forex System with High Win/Loss Ratio

You can work with more personal involvement with the system that exhibit high win/loss ratio. Besides that the big profit loss proportion presents worthwhile outcome of trading activities, even though you are not making ample sum to enhance the market liquidity.

Finally, it is the amalgamation of both the profit/loss and the win/loss proportions that are truly important. You must therefore, make an endeavor to look for the system in which mutually these factors are high.

What is PIP?

If you have two systems to evaluate, and both the systems have the identical float, in that case you can compare the win/loss ratio of these systems. It means to calculate the percentage of winner trades in comparison to that of losers.

Risk Multiple Principal

R multiple principal is one of the major information that you have to comprehend on Forex day trading. Here R stands for the Risk. It means the amount of risk you are willing to assume on any of the trade when you go in the market. In this regard, the R compound of a trade is the proportion of profit or loss as against the sum of cash put in a risk to earn revenue or incur loss.

For instance, if you put US$150 amount at risk in your preliminary buying, and you earn US$600. It signifies that you have made four times the sum of cash that you put on risk in this trade. Hence, the R multiple is 4 in this example. This data helps you in calculating the comparative volume of your profits to your losses.

People who liked this Post also read

- Low Budget Forex Trading Guide

The principle of low minimum investment has made Forex trading market very popular worldwide. People with small investment amount US$50 can also venture into it. Though you can join the Forex trading business with tight budget, but there are certain limit... - Forex Scalping Methods Explained

Forex scalping method is one of the most popular methods used in Forex trading. In the Forex scalping method of trading is for relatively short period of time. The investors also take profit after a little move in the markets. The scalpers are also the ma... - Foreign Exchange Spreads

Spread is an important but complicated parameter in forex trading industry that determines your ability to generate real profits. It is very important to understand forex spreads before working in in this industry.... - What a Beginner Should Do In Forex Trading?

Forex market is a highly volatile market that is complicated for beginner forex traders. Beginners can attain stable success in this field by working with useful strategies and skills. They have to be consistent and work hard to achieve firm position in f... - What Are the Best Times to Trade the US Dollar?

The US is the world's second biggest forex trading center. The best time to trade the USD is when the US session is in progress. You have to take care of certain things while trading in the US session whether you are working on long or short term basis....

1:33 PM | 0

comments

Labels:

Forex

Forex Markets Focus on Central Banks

Over the last year and increasingly over the last few months, Central Banks around the world have taken center stage in currency markets. First, came the ignition of the currency war and the consequent volley of forex interventions. Then came the prospect of monetary tightening and the unwinding of quantitative easing measures. As if that wasn’t enough to keep them busy, Central Banks have been forced to assume more prominent roles in regulating financial markets and drafting economic policy. With so much to do, perhaps it’s no wonder that Jean-Claude Trichet, head of the ECB, will leave his post at the end of this year!

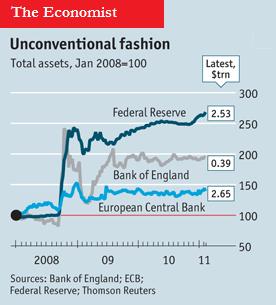

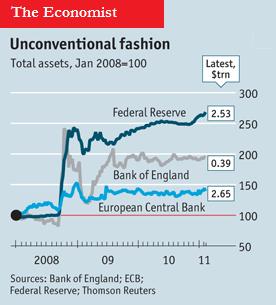

The currency wars may have subsided, but they haven’t ended. On both a paired and trade-weighted basis, the Dollar is declining rapidly. As a result, emerging market Central Banks are still doing everything they can to protect their respective currencies from rapid appreciation. As I’ve written in earlier posts, most Latin American and Asian Central Banks have already announced targeted strategies, and many intervene in forex markets on a daily basis. If the Japanese Yen continues to appreciate, you can bet the Bank of Japan (perhaps aided by the G7) will quickly jump back in.You can expect the currency wars to continue until the quantitative easing programs instituted by the G4 are withdrawn. The Fed’s $600 Billion Treasury bond buying program officially ends in June, at which point its balance sheet will near $3 Trillion. The European Central Bank has injected an equally large hunk of cash into the Eurozone economy. Despite inflation that may soon exceed 5%, the Bank of England voted not to sell its cache of QE assets, while the Bank of Japan is actually ratcheting up its program as a result of the earthquake-induced catastrophe. Whether or not this manifests itself in higher inflation, investors have signaled their distaste by bidding up the price of gold to a new record high.

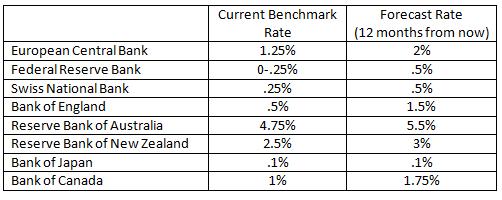

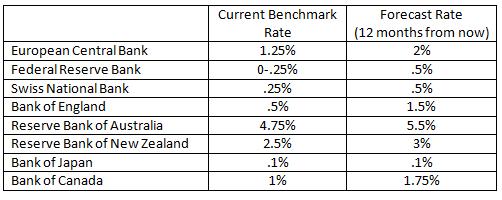

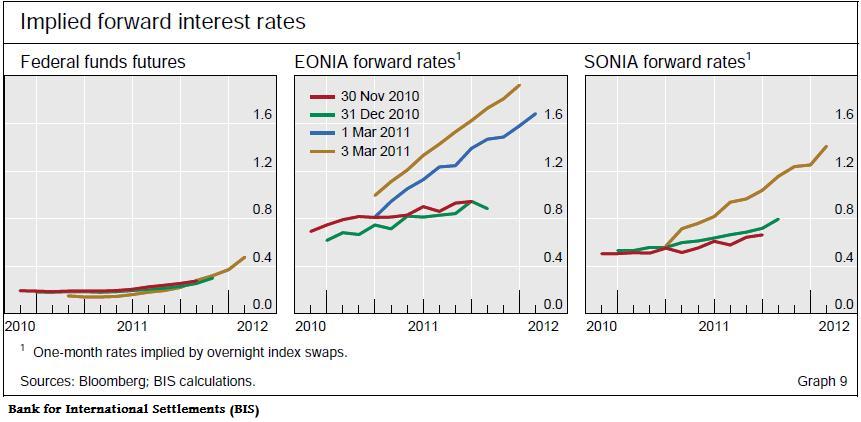

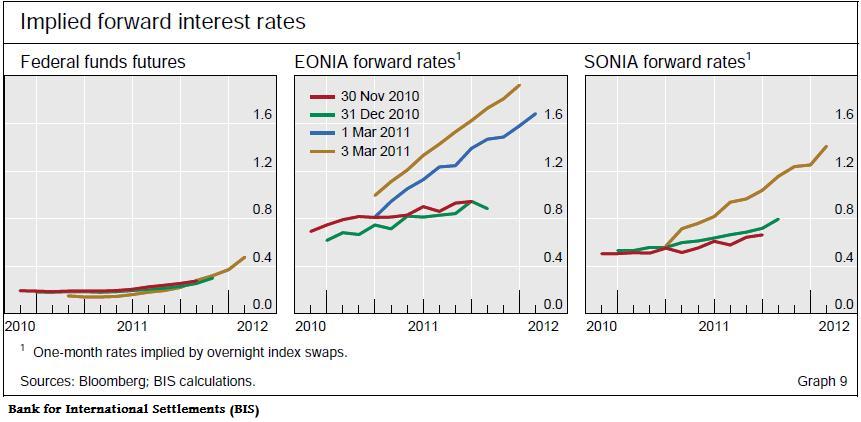

Then there are the prospective rate hikes, cascading across the world. Last week, the European Central Bank became the first in the G4 to hike rates (though market rates have hardly budged). The Reserve Bank of Australia, however, was the first of the majors to hike rates. Since October 2009, it has raised its benchmark by 175 basis points; its 4.75% cash rate is easily the highest in the industrialized world. The Bank of Canada started hiking in June 2010, but has kept its benchmark on hold at 1% since September. The Reserve Bank of New Zealand lowered its benchmark to a record low 2.5% as a result of serious earthquakes and economic weakness.

Going forward, expectations are for all Central Banks to continue (or begin) hiking rates at a gradual pace over the next couple years. If forecasts prove to be accurate, the US Federal Funds Rate will stand around .5% at the beginning of 2012, tied with Switzerland, and ahead of only Japan. The UK Rate will stand slightly above 1%, while the Eurozone and Canadian benchmarks will be closer to 2%. The RBA cash rate should exceed 5%. Rates in emerging markets will probably be even higher, as all four BRIC countries (Russia, Brazil, China, India) should be well into the tightening cycles.

On the one hand, there is reason to believe that the pace of rate hikes will be slower than expected. Economic growth remains tepid across the industrialized world, and Central Banks are wary about spooking their economies with premature rate hikes. Besides, Fed watchers may have learned a lesson as a result of a brief bout of over-excitement in 2010 that ultimately led to nothing. The Economist has reported that, “Markets habitually assign too much weight to the hawks, however. The real power at the Fed rests with its leaders…At present they are sanguine about inflation and worried about unemployment, which means a rate rise this year is unlikely.” Even the ECB disappointed traders by (deliberately) adopting a soft stance in the press release that accompanied its recent rate hike.

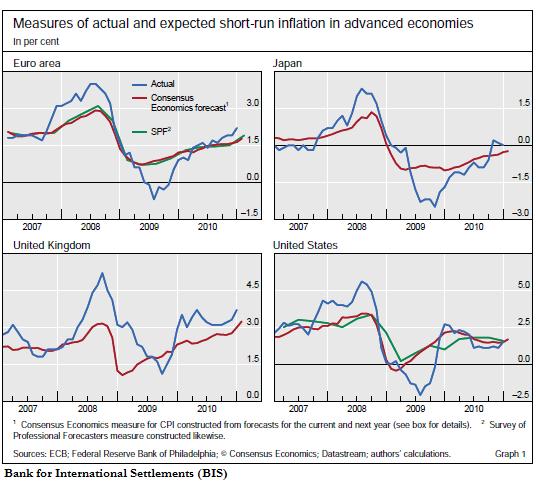

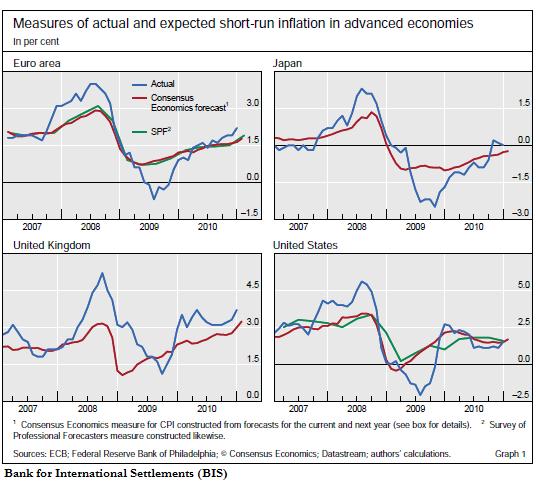

On the other hand, a recent paper published by the Bank for International Settlements (BIS) showed that the markets’ track record of forecasting inflation is weak. As you can see from the chart below, they tend to reflect the general trend in inflation, but underestimate when the direction changes suddenly. (This is perhaps similar to the “fat-tail” problem, whereby extreme aberrations in asset price returns are poorly accounted for in financial models). If you apply this to the current economic environment, it suggests that inflation will probably be much higher-than-expected, and Central Banks will be forced to compensate by hiking rates a faster pace.

Finally, in their newfound roles as economic policymakers, Central Banks are increasingly engaged in macroprudential policy. The Economist reports that, “Central banks and regulators in emerging economies have already imposed a host of measures to cool property prices and capital inflows.” These measures are worth watching because their chief aim is to indirectly reduce inflation. If they are successful, it will limit the need for interest rate hikes and reduce upward pressure on their currencies.

Finally, in their newfound roles as economic policymakers, Central Banks are increasingly engaged in macroprudential policy. The Economist reports that, “Central banks and regulators in emerging economies have already imposed a host of measures to cool property prices and capital inflows.” These measures are worth watching because their chief aim is to indirectly reduce inflation. If they are successful, it will limit the need for interest rate hikes and reduce upward pressure on their currencies.

In short, given the enhanced ability of Central Banks to dictate exchange rates, traders with long-term outlooks may need to adjust their strategies accordingly. That means not only knowing who is expected to raise interest rates – as well as when and by how much – but also monitoring the use of their other tools, such as balance sheet expansion, efforts to cool asset price bubbles, and deliberate manipulation of exchange rates.

The currency wars may have subsided, but they haven’t ended. On both a paired and trade-weighted basis, the Dollar is declining rapidly. As a result, emerging market Central Banks are still doing everything they can to protect their respective currencies from rapid appreciation. As I’ve written in earlier posts, most Latin American and Asian Central Banks have already announced targeted strategies, and many intervene in forex markets on a daily basis. If the Japanese Yen continues to appreciate, you can bet the Bank of Japan (perhaps aided by the G7) will quickly jump back in.

Then there are the prospective rate hikes, cascading across the world. Last week, the European Central Bank became the first in the G4 to hike rates (though market rates have hardly budged). The Reserve Bank of Australia, however, was the first of the majors to hike rates. Since October 2009, it has raised its benchmark by 175 basis points; its 4.75% cash rate is easily the highest in the industrialized world. The Bank of Canada started hiking in June 2010, but has kept its benchmark on hold at 1% since September. The Reserve Bank of New Zealand lowered its benchmark to a record low 2.5% as a result of serious earthquakes and economic weakness.

Going forward, expectations are for all Central Banks to continue (or begin) hiking rates at a gradual pace over the next couple years. If forecasts prove to be accurate, the US Federal Funds Rate will stand around .5% at the beginning of 2012, tied with Switzerland, and ahead of only Japan. The UK Rate will stand slightly above 1%, while the Eurozone and Canadian benchmarks will be closer to 2%. The RBA cash rate should exceed 5%. Rates in emerging markets will probably be even higher, as all four BRIC countries (Russia, Brazil, China, India) should be well into the tightening cycles.

On the one hand, there is reason to believe that the pace of rate hikes will be slower than expected. Economic growth remains tepid across the industrialized world, and Central Banks are wary about spooking their economies with premature rate hikes. Besides, Fed watchers may have learned a lesson as a result of a brief bout of over-excitement in 2010 that ultimately led to nothing. The Economist has reported that, “Markets habitually assign too much weight to the hawks, however. The real power at the Fed rests with its leaders…At present they are sanguine about inflation and worried about unemployment, which means a rate rise this year is unlikely.” Even the ECB disappointed traders by (deliberately) adopting a soft stance in the press release that accompanied its recent rate hike.

On the other hand, a recent paper published by the Bank for International Settlements (BIS) showed that the markets’ track record of forecasting inflation is weak. As you can see from the chart below, they tend to reflect the general trend in inflation, but underestimate when the direction changes suddenly. (This is perhaps similar to the “fat-tail” problem, whereby extreme aberrations in asset price returns are poorly accounted for in financial models). If you apply this to the current economic environment, it suggests that inflation will probably be much higher-than-expected, and Central Banks will be forced to compensate by hiking rates a faster pace.

Finally, in their newfound roles as economic policymakers, Central Banks are increasingly engaged in macroprudential policy. The Economist reports that, “Central banks and regulators in emerging economies have already imposed a host of measures to cool property prices and capital inflows.” These measures are worth watching because their chief aim is to indirectly reduce inflation. If they are successful, it will limit the need for interest rate hikes and reduce upward pressure on their currencies.

Finally, in their newfound roles as economic policymakers, Central Banks are increasingly engaged in macroprudential policy. The Economist reports that, “Central banks and regulators in emerging economies have already imposed a host of measures to cool property prices and capital inflows.” These measures are worth watching because their chief aim is to indirectly reduce inflation. If they are successful, it will limit the need for interest rate hikes and reduce upward pressure on their currencies.In short, given the enhanced ability of Central Banks to dictate exchange rates, traders with long-term outlooks may need to adjust their strategies accordingly. That means not only knowing who is expected to raise interest rates – as well as when and by how much – but also monitoring the use of their other tools, such as balance sheet expansion, efforts to cool asset price bubbles, and deliberate manipulation of exchange rates.

1:31 PM | 0

comments

Labels:

Forex

Time to Short the Euro

Over the last three months, the Euro has appreciated 10% against the Dollar and by smaller margins against a handful of other currencies. Over the last twelve months, that figure is closer to 20%. That’s in spite of anemic Eurozone GDP growth, serious fiscal issues, the increasing likelihood of one or more sovereign debt defaults, and a current account deficit to boot. In short, I think it might be time to short the Euro.

There’s very little mystery as to why the Euro is appreciating. In two words: interest rates. Last week, the European Central Bank (ECB) became the first G4 Central Bank to hike its benchmark interest rate. Moreover, it’s expected to raise rates by an additional 100 basis points over the next twelve months. Given that the Bank of England, Bank of Japan, and US Federal Reserve Bank have yet to unwind their respective quantitative easing programs, it’s no wonder that futures markets have priced in a healthy interest rate advantage into the Euro well into 2012.

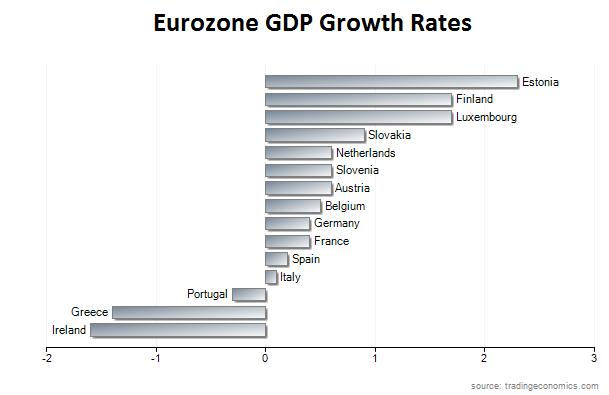

From where I’m sitting, the ECB rate hike was fundamentally illogical, and perhaps even counterproductive. Granted, the ECB was created to ensure price stability, and its mandate is less nuanced than its counterparts, which are charged also with facilitating employment and GDP growth. Even from this perspective, however, it looks like the ECB jumped the gun. Inflation in the EU is a moderate 2.7%, which is among the lowest in the world. Other Central Banks have taken note of rising inflation, but only the ECB feels compelled enough to preemptively address it. In addition, GDP growth is a paltry .3% across the EU, and is in fact negative in Greece, Ireland, and Portugal. As if the rate hike wasn’t bad enough, all three countries must contend with a hike in their already stratospheric borrowing costs, ironically making default more likely. Talk about not seeing the forest for the trees!